Retirement: It’s Time to Sell Your Business

3 Practical Tips You Can Take to the Bank

In today’s world of “instant,” concepts such as value and worth may no longer be second nature to many of us. For instance, an appraisal of the monetary value or worth of your business, as you anticipate selling it to fund your retirement plan, can depend on a variety of factors you might not have thought of—including whether you have paved the way for selling it and how quickly you want to exit.

Tracey M. Jasey, Partner, MPI Business Valuation & Advisory, has built her professional practice on helping business owners to navigate the complex issues pertaining to business value and worth. Key to her success is her commitment to education, planning, and the recognition that timing is everything.

Jasey’s perspective can help you, too, as you read our real-life illustrations, presenting 3 Practical Tips You Can Take to the Bank:

1. Educate yourself

2. Plan

3. Timing is everything

Click on each to meet Erin, James and the Hadley sisters. Learn how they prepared to maximize the worth of their respective businesses, before exiting. And remember to reach out to us today and start a conversation—as you aim to maximize the value of your business, as a primary component of your retirement planning.

1. Educate yourself

Erin owns a professional practice that she established as an LLC over a decade ago. One morning, the need to start planning for her retirement crossed her mind. It then occurred to her how smart she had been to utilize a corporate structure for her practice, because she could sell shares of her business rather than finding just one buyer when she retired.

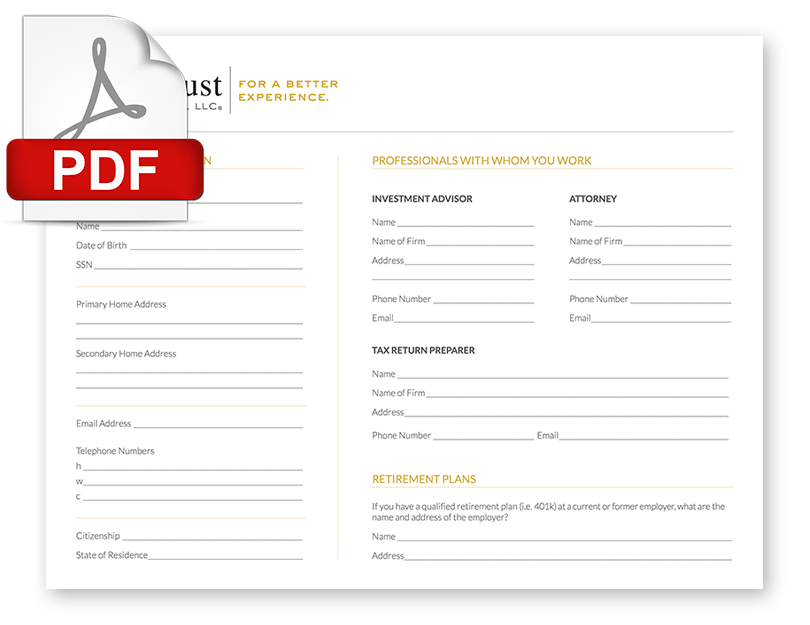

But how much were the shares in her private company worth? Erin realized that she had never taken the time to have her business valued. And the compensation structure at her firm was based solely upon revenue as income—there was no formula in place for a payout of equity to her as owner. What a wake-up call. Erin placed a call to Entrust; she knew she needed to educate herself but was unsure where to start.

2. Plan

James had spent over twenty years building his manufacturing firm. He knew he could not work forever and figured that someday, when he was ready to retire, he would just put his business up for sale—like he put his starter home up for sale after he and his wife had their two children and needed more space.

James had spent over twenty years building his manufacturing firm. He knew he could not work forever and figured that someday, when he was ready to retire, he would just put his business up for sale—like he put his starter home up for sale after he and his wife had their two children and needed more space.

James’ simple exit strategy was upended when he happened to attend a professional networking dinner and hear a presentation that touched on three different types of sale processes for small businesses:

“Whoa,” he thought. “I have some planning to do. And considering when I would like to retire, there is no time to lose.” He got out his phone and emailed us at Entrust before heading home that night.

3. Timing is everything

The Hadley sisters’ Café had developed a reputation in town for serving the best breakfast and lunch within miles. They were thrilled about this and passionate about their business but knew instinctively that this was not enough; taking deliberate action to slowly increase the value of their Café business mattered, too. To that end, they had it valued every couple of years; they thought of the appraisals as a “report card,” showing them how they were doing over time.

The Hadley sisters’ Café had developed a reputation in town for serving the best breakfast and lunch within miles. They were thrilled about this and passionate about their business but knew instinctively that this was not enough; taking deliberate action to slowly increase the value of their Café business mattered, too. To that end, they had it valued every couple of years; they thought of the appraisals as a “report card,” showing them how they were doing over time.

Along the way the sisters learned about three primary types of business sales they would likely need to select from when the right time came. However, what they found (in their words) “almost painful,” was choosing the right time to let go of their baby. Having put their hearts and souls into their Café for years made the idea of walking away tough—even if they were offered an excellent purchase price.

The Hadley sisters looked at one another and agreed, “We need an objective advisor with thoughtful perspective to weigh in about the timing of our sale. Left to our own devices, we will never be able to pick the right time.” It was time for a heart-to-heart with Entrust.