Managing Wealth

Whether you’re in your 20s making your first investment, in your 40s balancing family and career, or in your 60s planning your next chapter, the best time to map out your financial future is now. Planning isn’t about predicting the future — it’s about being ready for it.

Spring is the perfect time to reset and reorganize your financial life. Just like the feel-good experience of decluttering your home, financial spring cleaning reduces stress as you identify areas...

It’s that time of year again—tax season! While the Eagles are headed toward the Super Bowl, let’s focus on another big kick-off— the official start of tax season: January 27th, 2025.

Your 401(k) can be either a trick or a treat depending on how you use it. Not funding your 401(k) is a trick that could jeopardize your financial future, while regular contributions are one of the best financial treats you can give yourself.

Behavioral finance always plays a big role when it comes to investor decision-making, but it becomes especially important during emotionally charged times—like presidential election years.

Inheriting money can be a life-changing opportunity and provide financial stability. On the other hand, it could lead to excessive spending, with a beneficiary quickly exhausting new-found wealth. When you inherit money, which result would you choose?

Written by: Joslyn G Ewart, CFP®, Jay Llewelyn, CFA® Telecom and Tech Telecom and Tech are the sectors driving the capital markets so far in 2024. Entrust investors benefit from these sectors due to their diversified portfolios—primarily in their positions invested in large company domestic stocks, mutual funds and/or ETFs. More specifically, of the large company stocks in these portfolios, companies that are actively pursuing generative AI research make up between 7 to 10% of the portfolio holdings. The ...

If you are like most investors, you would like perspective on how financial market trends may affect your portfolio of investments. For user-friendly commentary, please enjoy the quick read and chart following. As always, our Entrust advisors welcome the opportunity for a conversation. Entrust Financial LLC® Market Commentary for the First Quarter, 2021 Following a record-breaking year, capital markets continued their rally through the first quarter of 2021. Factors such as increased vaccine distribution combined with additional government stimulus ...

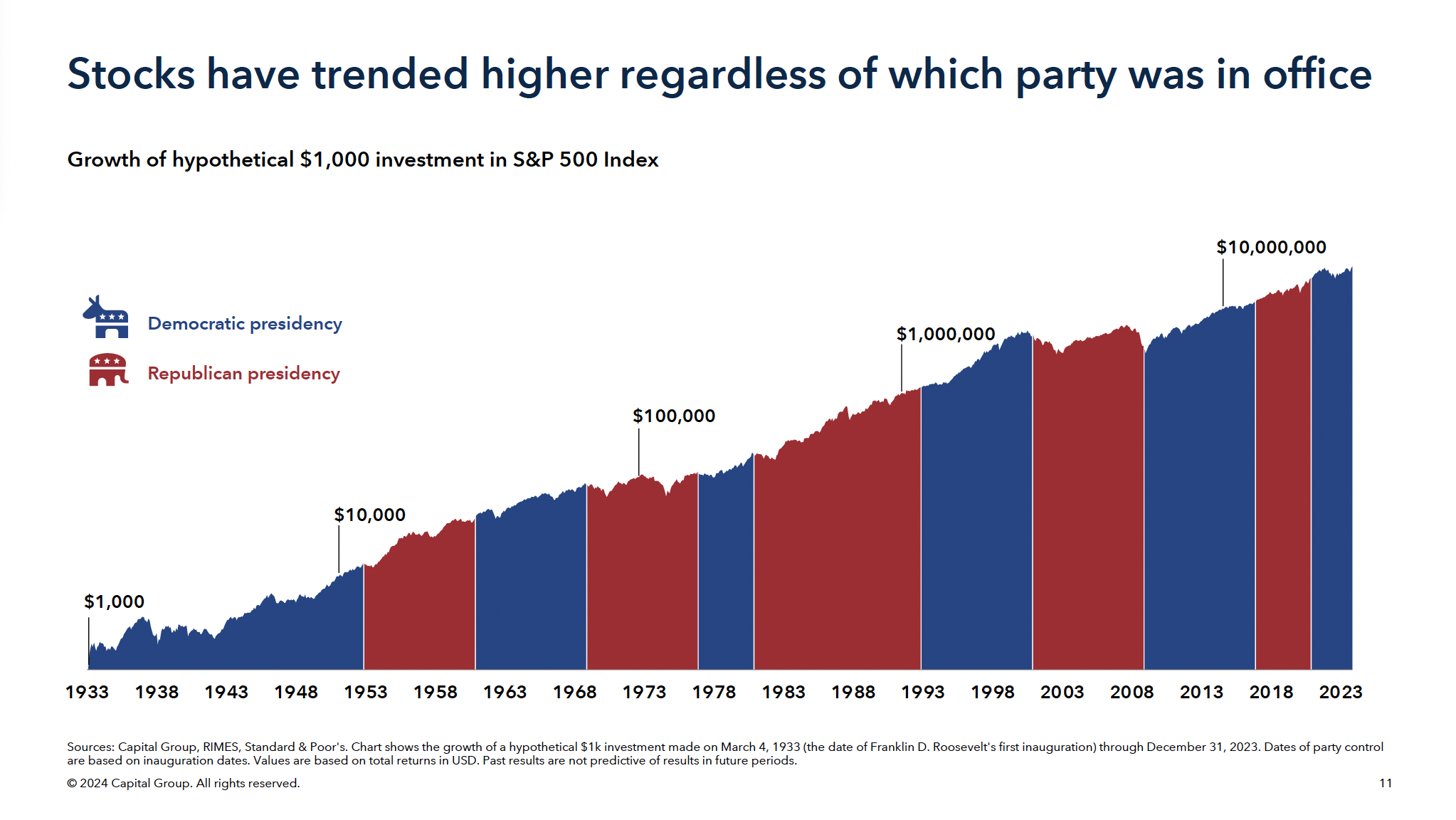

Investors have faced a lot of uncertainty so far this year, particularly due to the pandemic, and it is not over yet. One reason is that Presidential election years, by definition, cause some concern about what might come next. We would like to reassure you by mentioning that research¹, from 1933 to the present, indicates that capital market returns have stayed strong over the long-term—regardless of the partisan makeup of Washington. That said, we would also like to offer you ...

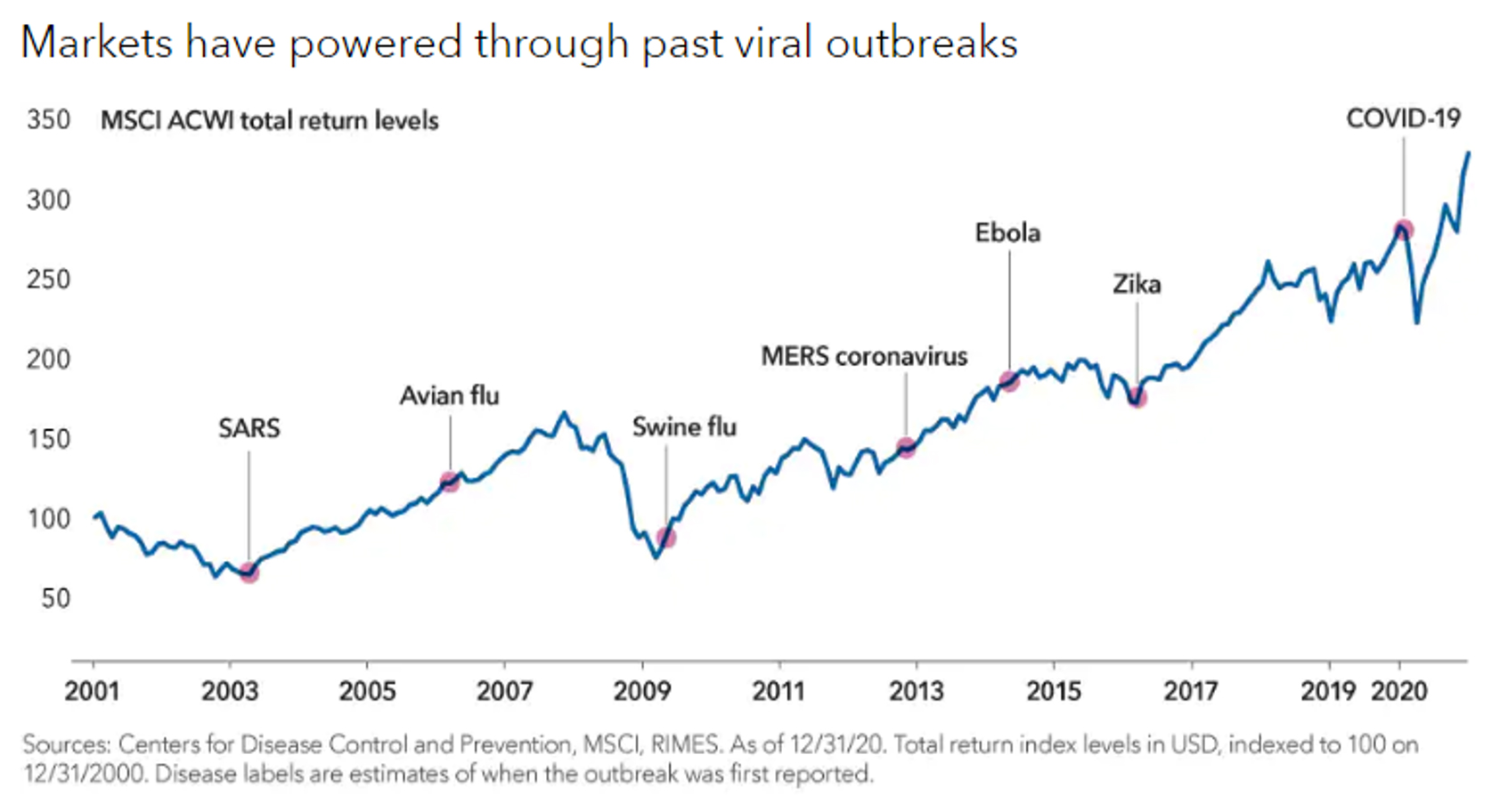

Uncertainty continues to be a primary characteristic of our current experience, as it has been since the beginning of the spring season. And if you are like many of us, this uncertainty may be causing financial questions to swirl in your mind. We have answers and as our Entrust clients know, we have a structure in place to provide them to those not yet working with us—Entrust’s Second Opinion Service. What about cost? Spending extra money right now for ...