Wealth Management

Another year is upon us, complete with new personal goals and plans to fulfill former ones. For any investor who spent a lot of time stressing over the volatile capital markets last year...

September is the month many of us associate with “back to school.” September of 2021 is a singular back to school moment for many students who experienced an interruption to their in-person education due to the pandemic. Perhaps that makes this school year extra special and a good time to re-evaluate your child’s financial education. After all, you are preparing your children for a self-sufficient future, not to boomerang back to the care of mom and dad! Our Entrust advisors ...

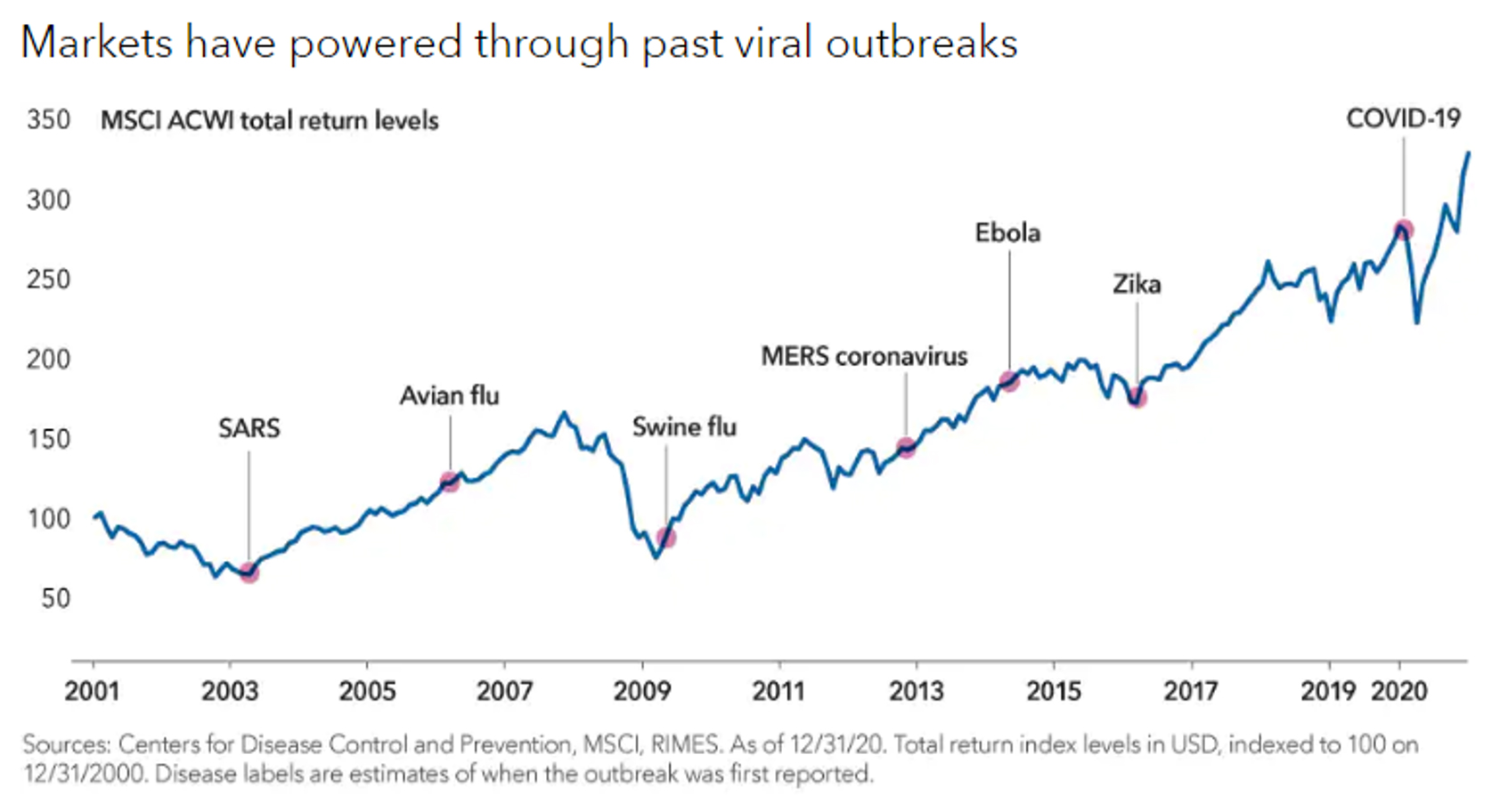

If you are like most investors, you would like perspective on how financial market trends may affect your portfolio of investments. For user-friendly commentary, please enjoy the quick read and chart following. As always, our Entrust advisors welcome the opportunity for a conversation. Entrust Financial LLC® Market Commentary for the First Quarter, 2021 Following a record-breaking year, capital markets continued their rally through the first quarter of 2021. Factors such as increased vaccine distribution combined with additional government stimulus ...

Part One of Three Joslyn G Ewart, CFP® — July 14, 2020 A nugget of wisdom that Warren Buffet has passed along more than once offers the perfect introduction to our discussion about retirement security: You only find out who is swimming naked when the tide goes out. In other words, any investor whose retirement plan was not formulated on a solid foundation was just faced with the truth during the pandemic-driven rapid market decline of March 2020. If ...

Uncertainty continues to be a primary characteristic of our current experience, as it has been since the beginning of the spring season. And if you are like many of us, this uncertainty may be causing financial questions to swirl in your mind. We have answers and as our Entrust clients know, we have a structure in place to provide them to those not yet working with us—Entrust’s Second Opinion Service. What about cost? Spending extra money right now for ...

For the past twelve weeks, we have provided weekly perspective about the medical and financial crises that struck in the early spring. As the nation segues from sheltering-in-place to heading back to some normal activities, many of us face a similar concern: What can we do to minimize our risk from the pandemic? This concern will likely be around for some time. Therefore, we would like to share the following New York Times article that offers helpful guidance for ...

We often hear news reports about decisions of the FOMC (Federal Open Market Committee) but are rarely in the presence of a committee member to learn about the goals and work of the group. Kudos to the Forum of Executive Women for hosting Lara Rhame, Chief U.S. Economist for FS Investments, interviewing Loretta J Mester, President and Chief Executive Officer of the Federal Reserve Bank of Cleveland. Mester’s perspective on current economic conditions was refreshing and confidence-inspiring in ...

Good News, Bad News for Your Retirement Accounts: The SECURE Act If you own a retirement account, you could experience good or bad news in the year ahead due to the recent passage of the “SECURE Act.” Good News If you have not yet been required to begin distributions from your retirement account(s) (the minimum amount you must withdraw from your account each year), you are now permitted to wait until you reach the age of 72, providing you ...

At Entrust Financial, we are often asked what our services are. We understand this question because financial lives today can have many moving parts, parts that often overlap and are complicated and confusing. Clients and friends who know us at Entrust are aware that we love every little detail of financial complexity and are thrilled to orchestrate financial success for our clients, so they can spend time on what they love instead! To help describe what differentiates Entrust Financial, ...

Owning your own home was a fundamental American value for many of us when we grew up. It was considered a symbol of success, of having “made it.” Those who did not felt they had missed out on something, that not owning helped prove their marginal financial success. For instance, Joslyn remembers her father freely expressing his frustration about not owning their family home. Because he was a minister, the tradition was for the congregation to pay a very ...