Investing

The change to a new season often prompts us to adopt new habits or practices to better experience what matters most to us. This is reminiscent of our client conversations about what is most important to them in their lives, particularly when when change is desired...

Good news abounded during the second quarter, with many factors contributing to the overall positive results. The Information Technology sector dominated the equity markets in the U.S., helped in large part by exciting advances in artificial intelligence...

Another year is upon us, complete with new personal goals and plans to fulfill former ones. For any investor who spent a lot of time stressing over the volatile capital markets last year...

The first two articles in our series, A Whole Lot Modern: Three Investment Pillars to Embrace Now, introduced investing with an Impact based upon one’s values, and investing with a sensitivity to ESG (Environmental, Social, Governance) concerns. Our discussion in article three: Investments with Impact and ESG will connect the two for investors while identifying important distinctions. The socially responsible considerations presented previously may seem similar, but they are distinct. For instance, if an investor is interested in ...

The article series, A Whole Lot Modern: Three Investment Pillars to Embrace Now, began with a focus on Investments with Impact, which feature an advocacy component in support of investors’ values. One example was a mutual fund that invests in the construction of solar farms. We continue by exploring Investments with ESG (Environmental, Social, Governance) analysis as an integral feature. Generally speaking, the aim of our second pillar—Investments with ESG—is to avoid certain companies and thereby “do less ...

This article series, A Whole Lot Modern: Three Investment Pillars to Embrace Now, will focus on: 1) Investments with Impact, 2) Investments with ESG (Environmental, Social, Governance) analysis, and 3) Investments with Impact and ESG. Investors today have a growing interest in aligning their personal values with their financial goals. Such investors embrace portfolios designed not only to help build and preserve their portfolio of assets as they aim to achieve their personal financial goals, but they have ...

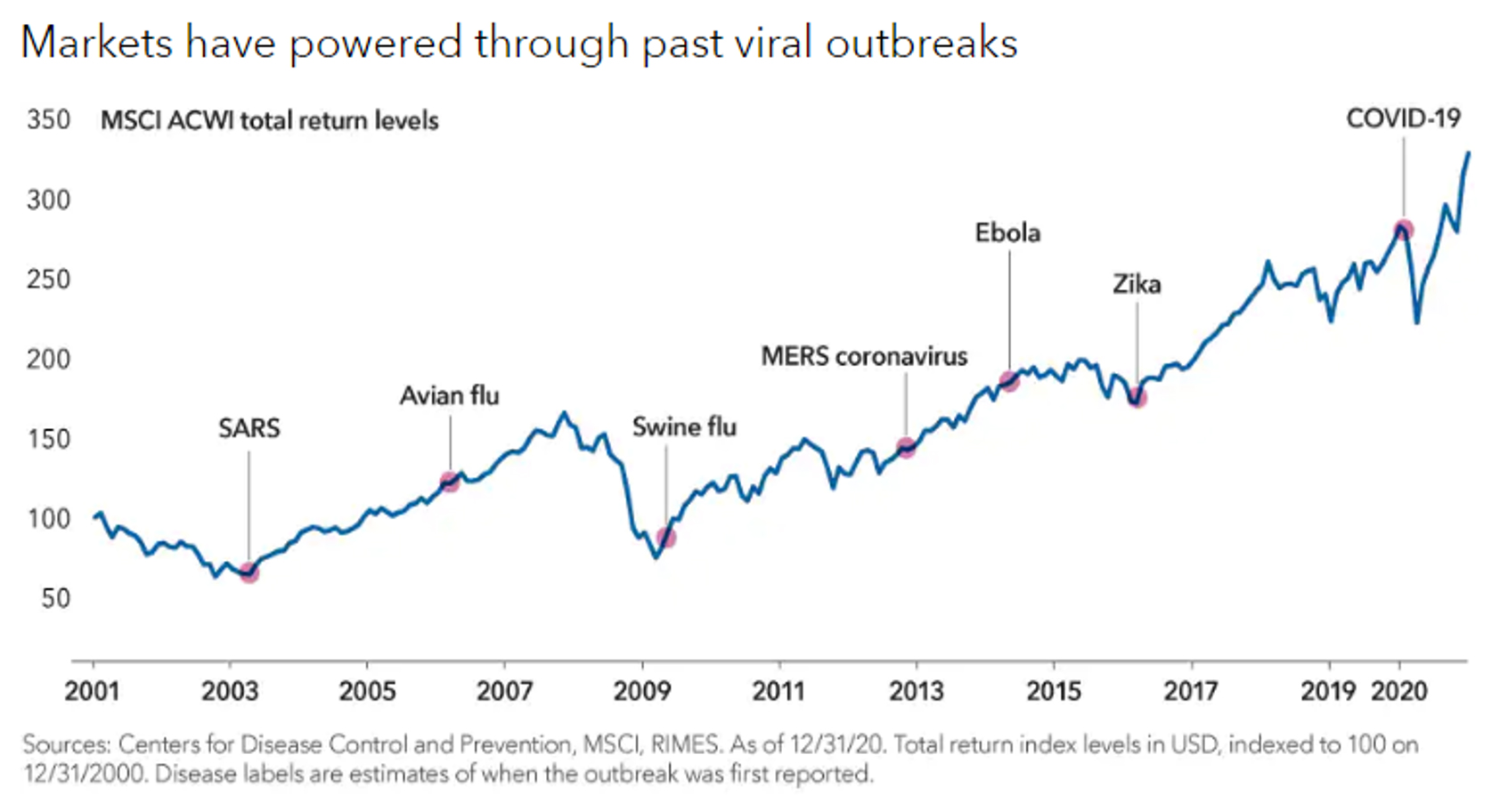

If you are like most investors, you would like perspective on how financial market trends may affect your portfolio of investments. For user-friendly commentary, please enjoy the quick read and chart following. As always, our Entrust advisors welcome the opportunity for a conversation. Entrust Financial LLC® Market Commentary for the First Quarter, 2021 Following a record-breaking year, capital markets continued their rally through the first quarter of 2021. Factors such as increased vaccine distribution combined with additional government stimulus ...

Part Three of Three Joslyn G Ewart, CFP® — September 15, 2020 There may be no better starting place for a discussion of Retirement Security in a Pandemic, III: Invest for the long-term, than a refresher regarding the marshmallow test. The marshmallow test was a study on delayed gratification led by Stanford University professor, Walter Mischel. The study offered young children two choices: one immediate small reward—a marshmallow—or, two small rewards if they waited for a period of time ...

Part Two of Three Joslyn G Ewart, CFP® — August 4, 2020 It is not uncommon for considerations of retirement security to begin with a debate about the capital markets: Will they go up or will they go down? This focus—just as you are trying to plan your retirement savings, establish your retirement date, or generate your desired amount of retirement income—can derail you from the actual considerations that lead to retirement security. The purpose of this series is ...

Part One of Three Joslyn G Ewart, CFP® — July 14, 2020 A nugget of wisdom that Warren Buffet has passed along more than once offers the perfect introduction to our discussion about retirement security: You only find out who is swimming naked when the tide goes out. In other words, any investor whose retirement plan was not formulated on a solid foundation was just faced with the truth during the pandemic-driven rapid market decline of March 2020. If ...