Recipe for Success

When we hear the word “recipe,” most of us think of food. And now that the summer season is here, foods with fresh ingredients are abundant–a welcome and nutritious change. But we can also apply the friendly term “recipe” to our portfolio asset allocation, recognizing that our portfolio ingredients are likely to be stocks, bonds and real estate. Fortunately, when we get the proportions right, these investment ingredients may deliver welcome results and keep us financially healthy.

Sue’s experience provides a perfect illustration. Sue is a meticulous and successful entrepreneur with a strong commitment to preserving what she has accumulated. Before we met, she had not paid much attention to the ingredients in her portfolio. She assumed that her long-time advisor, whom she inherited ten years ago along with the money from her father, was doing just that for her. Furthermore, because she recognized the names of the companies in her portfolio as “good companies,” she figured she did not have to worry about a loss in value.

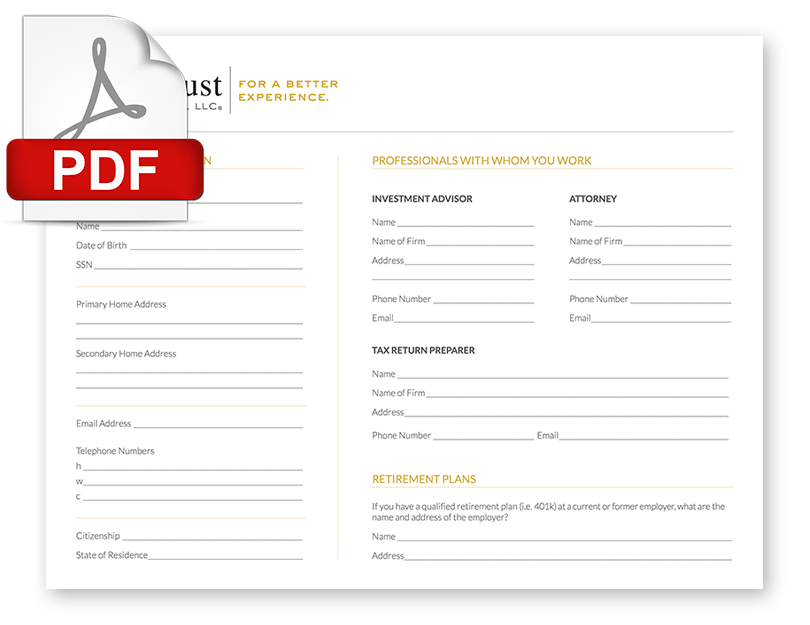

However, Sue decided to talk to a different advisor about her most important financial goals, especially her primary goal of “making work optional” for herself and for her partner. Therefore, she scheduled a meeting with our Entrust team: 1) to discuss her financial goals, and 2) for a second opinion about whether her current portfolio of investments was on track to help her achieve them.

None too soon! Analysis of her investments revealed that over the years, Sue’s portfolio had become concentrated in just a few stocks. Not only did this concentration increase her risk, but the fact that the stock positions she held were all in just one sector of the market also resulted in greater risk than she had intended. Sue now realized that if she continued to hold concentrated positions going forward, her portfolio would have little chance to deliver the consistent and reliable appreciation she needed to achieve her primary goal, that of making work optional.

As an alternative, we introduced Sue to the risk-management strategy of allocating her money across a variety of ingredients (assets), such as stocks, bonds and real estate. She agreed to the diversification recipe we presented and her decision was soon validated. Not long after the implementation of her new portfolio asset allocation was completed, one of her former technology stocks plummeted in value. She is thrilled to have escaped the volatility of single-sector investing before the worst occurred!

Selection of the right portfolio ingredients can serve as a recipe for success and result in the achievement of investors’ most important goals. Contact us today for a second opinion about the health of the asset allocation recipe for your portfolio of investments.