Entrust Blog

Investors have faced a lot of uncertainty so far this year, particularly due to the pandemic, and it is not over yet. One reason is that Presidential election years, by definition, cause some concern about what might come next. We would like to reassure you by mentioning that research¹, from 1933 to the present, indicates that capital market returns have stayed strong over the long-term—regardless of the partisan makeup of Washington. That said, we would also like to offer you ...

Part Three of Three Joslyn G Ewart, CFP® — September 15, 2020 There may be no better starting place for a discussion of Retirement Security in a Pandemic, III: Invest for the long-term, than a refresher regarding the marshmallow test. The marshmallow test was a study on delayed gratification led by Stanford University professor, Walter Mischel. The study offered young children two choices: one immediate small reward—a marshmallow—or, two small rewards if they waited for a period of time ...

Part Two of Three Joslyn G Ewart, CFP® — August 4, 2020 It is not uncommon for considerations of retirement security to begin with a debate about the capital markets: Will they go up or will they go down? This focus—just as you are trying to plan your retirement savings, establish your retirement date, or generate your desired amount of retirement income—can derail you from the actual considerations that lead to retirement security. The purpose of this series is ...

Part One of Three Joslyn G Ewart, CFP® — July 14, 2020 A nugget of wisdom that Warren Buffet has passed along more than once offers the perfect introduction to our discussion about retirement security: You only find out who is swimming naked when the tide goes out. In other words, any investor whose retirement plan was not formulated on a solid foundation was just faced with the truth during the pandemic-driven rapid market decline of March 2020. If ...

On the one hand, we wish we never had to read or hear another word about “the virus.” On the other, while hoping to avoid infection, if we were to become ill, we would want to respond quickly and effectively. Therefore, it is vital to stay apprised of the current understanding of the medical community regarding symptoms and the subsequent right actions to take. This New York Times article: “‘What Are the Symptoms?’ ‘What Should I Do if I Feel ...

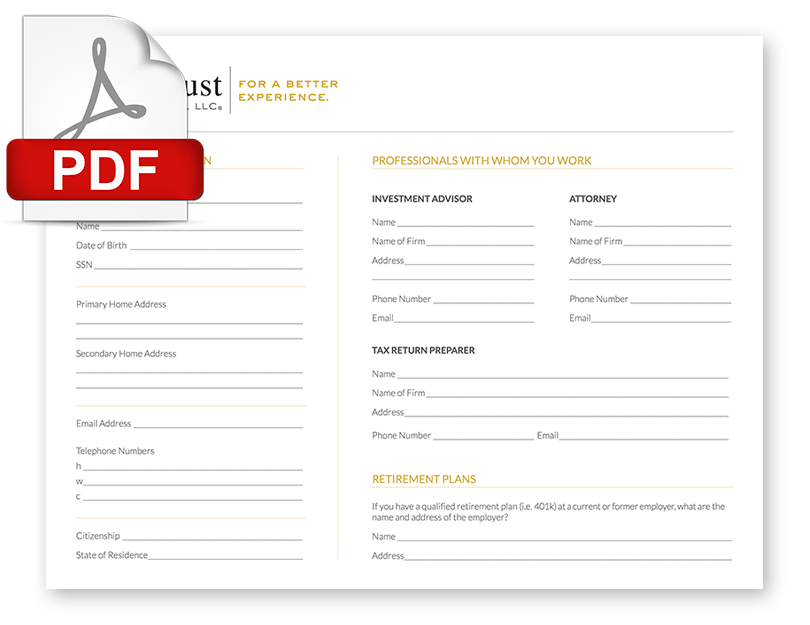

Our team at Entrust Financial works hard to assist our clients in managing their finances and making sure their money works as hard as they do. We are an independent firm with a strong commitment to providing objective, customized advice and we adhere to the fiduciary standard of always putting our clients’ best interests before our own. Our main goal is to create a better life experience for every Entrust client, as well as to ensure they are comfortable and ...

Uncertainty continues to be a primary characteristic of our current experience, as it has been since the beginning of the spring season. And if you are like many of us, this uncertainty may be causing financial questions to swirl in your mind. We have answers and as our Entrust clients know, we have a structure in place to provide them to those not yet working with us—Entrust’s Second Opinion Service. What about cost? Spending extra money right now for ...

For the past twelve weeks, we have provided weekly perspective about the medical and financial crises that struck in the early spring. As the nation segues from sheltering-in-place to heading back to some normal activities, many of us face a similar concern: What can we do to minimize our risk from the pandemic? This concern will likely be around for some time. Therefore, we would like to share the following New York Times article that offers helpful guidance for ...

We mentioned in our previous article that recovery expectations differ widely across the generations, as reported in the current research of one of our strategic partners, Capital Group’s American Funds. The graph provided, illustrating S&P 500 investment returns during each age group’s working years, provides a context for the generationally specific investment results indicated below. Capital Group research conducted in January of 2020 reported annual portfolio return expectations by generation¹: Gen Z ...

The celebration of the Memorial Day holiday is quickly approaching. Typically, we eagerly anticipate this three-day weekend that heralds the beginning of the summer season. This year is different. However, some traces of good news are beginning to surface that suggest a pretty good summer may be on the horizon after all. Specifically, it is now being suggested that socializing outside may be an effective strategy as we take initial steps to recover from the current crises. Financial questions as ...