Our Money: What Successful Couples Do

You would not expect a business to succeed unless the owners established short and long-term goals, and took the time to track expenses and income. When it comes to couples and money, the same expectations hold true. Setting goals and tracking financials can make all the difference to a lifetime of financial success.

But as you know, not all couples experience financial success. What stands in the way? First, couples are often unsure how to collaborate with one another to make good financial decisions. Second, money is personal and each partner brings his or her own values, desires, habits, and baggage from the past into the conversation. However, as you are about to see with the story of Eva and Brian, the past does not have to present an obstacle course to financial bliss within relationships.

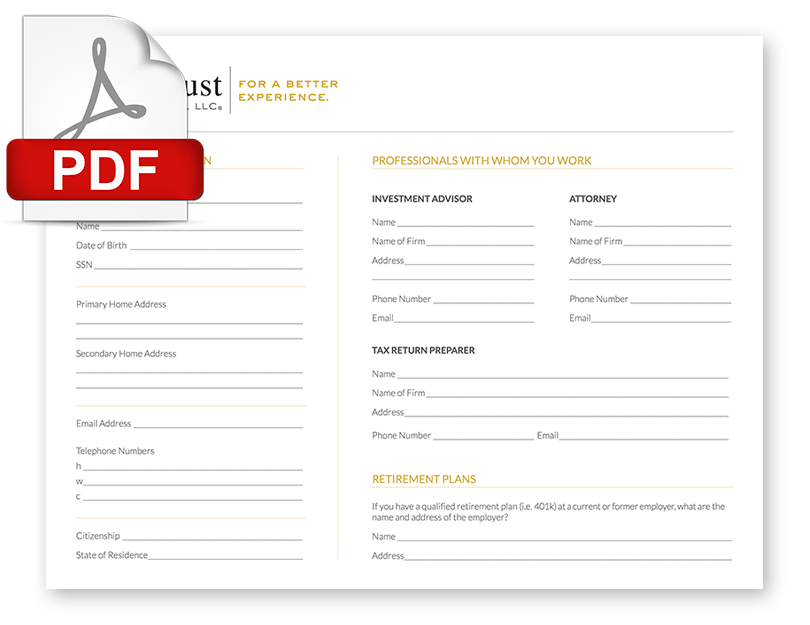

Eva, aged forty-two, works for a local university and was never married. Brian, aged fifty, is a partner at a large law firm and has two children from his first marriage. You can imagine how different their incomes, savings, and lifestyle choices were before they met. They decided to contact Entrust due to their uncertainty about how to fairly join their diverse finances and investments, a goal they wished to achieve prior to their upcoming marriage.

While there is no magic formula because financial success in marriage is a journey, not an end-game, the following steps helped Eva and Brian to get on track:

- Put all your cards on the table. Before you marry, be honest about where you are today financially––review your current situation, including your income, expenses, debt, savings, and financial goals. Not surprisingly, this type of truth party takes courage. In our illustration, Eva was ashamed that she still had some student loan debt to re-pay; Brian was embarrassed that his investments had been in cash since 2008.

- Determine your income and expenses. With a clear understanding of the pieces of their financial puzzle, Eva and Brian were then able to collaborate regarding expenses. They now use mint.com to make it easy to monitor their cash-flow, and report how reassuring it feels to know how much money comes in, how much goes out, and to have a firm grasp on where their money is spent.

- Create and work toward precise goals, and specify timelines for achieving them. Brian and Eva are excited to be aiming toward achieving retirement goals as well as planning to provide for an elderly parent and special needs child. They conduct monthly financial check-ups and find creative ways to celebrate when their progress reports are right on track.

Today, Eva and Brian feel a revitalized sense of financial security because they know that they are on track–collaborating and sharing responsibility for achieving everything they need for a lifetime of financial success. If you need help fine-tuning the financial bliss in your relationship, contact us right now: contactus@entrustfinancial.com or 610-687-3515.