I Want to Do the Right Thing with My Inheritance

Bizzie, a thoughtful and practical woman who has carefully cultivated her legal consulting practice for decades, is married to a high school music teacher and has one son–a teenager soon to complete his senior year and head off to college. Our story begins when Bizzie inherits a substantial amount of money following the sudden death of her father. While the handling of the family finances was always her husband’s responsibility, upon receiving this inheritance–which felt like a windfall to Bizzie–she realized she wanted to take charge of this money and for the first time in her life become financially literate. Bizzie wanted to be confident of doing the right thing; after all, this inheritance was high stakes money for her.

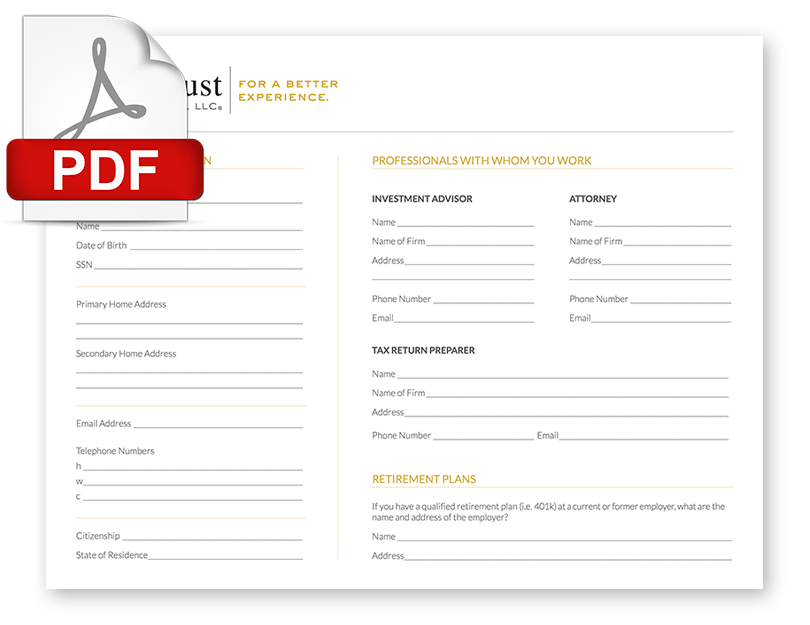

Bizzie quickly determined that step one on the road to financial literacy was to hire the right financial advisor. A linchpin for her, as she researched with whom to work, was learning about Entrust Financial’s commitment to planning and having a team of advisors who are Certified Financial Planner™ Professionals. When she contacted us to schedule a consultation, one of the first things she said was, “I want to do the right thing with my inheritance. I hope that with proper planning my father’s gift will make it possible for my family to achieve our most important financial goals.”

During our initial consultation Bizzie was articulate in sharing her goals, which included:

- Prepare for a secure retirement

- Provide a college education for our son

- Earmark a $2 million-dollar legacy for our son

As we worked with Bizzie to formulate and implement a wealth plan for achieving her stated goals, we recommended an assignment: develop a precise understanding of expenses by tracking all family expenses over a period of several months using this budget spreadsheet. She was thrilled when this homework assignment allowed her to answer the question, “What does my family need to spend to be comfortable?”

Although she completed the expenses-tracking assignment in preparation for the successful implementation of her wealth plan, two excellent and unexpected outcomes resulted from her efforts:

- She discovered her husband did not prefer to be solely in charge of the family finances. In fact, he indicated that going forward he was thrilled to share this responsibility with Bizzie, who enjoys the details far more than he.

- She discovered that her inheritance portfolio could provide income today, thereby allowing her to take a step back from her consulting practice and finally pursue her dream of attaining her doctoral degree.

As Bizzie and her family experienced, “doing the right thing with your inheritance” can have far-reaching effects, superb outcomes that go beyond financial confidence and a sense of security knowing the achievement of important goals is within reach. Contact us today to explore how to accomplish your most important financial goals.