Holistic Wealth Management: Package Your Personal Finances for a Lifetime of Success

When I established my holistic financial planning firm in 2000, I was advised by colleagues to avoid using the word “holistic” to describe Entrust Financial’s services. “It sounds too new age,” they said, “Like you are reading taro cards or something. It just doesn’t sound like you are offering rigorous financial and investment advice.”

I admit I was puzzled by the strong negative reaction to the word holistic because to me, offering financial advice using a holistic process was the natural outcome of observing what clients needed to be successful. For example, early in my career I was referred a couple, Emily and Dan, who reported they wanted to meet because they were “hemorrhaging money.” To them, this meant that although they inherited a substantial portfolio a couple of years before, they had already dissipated about $2 million dollars of it.

How could this be? Two things stood out when we completed our discovery meeting. First, the allocation of their inherited portfolio was not structured to generate the income they were taking or to minimize taxes. Second, Emily and Dan had inadvertently overlooked the need to plan for their family’s financial concerns that went beyond investing. These concerns proved not only expensive but extensive as well, including things such as: promised payment of expensive college tuitions for four children, long-term care expenses for a parent, and private, unreimbursed therapist expenses for their children, to name a few. Not surprisingly, the money hemorrhaging continued until we were able to reallocate their portfolio with a tax-sensitive income objective and to address their family’s other financial concerns.

Let us return to the term holistic for a moment. It is an adjective that means to comprehend the parts of something as intimately interconnected and understandable only by reference to the whole¹. Emily and Dan were faced with a dissipated portfolio because they had failed to look at the interconnection between the asset allocation of their inherited portfolio, their family’s financial concerns that went beyond investing, the inevitable tax consequences, and their current need for income. Fortunately, Entrust’s commitment to using a holistic process provided the structure they needed to turn things around and re-position their personal finances for long-term success.

Today, unlike in 2000, Entrust can use the word holistic with confidence, knowing the term is a positive indicator of the extra layer of care we provide to clients. In fact, when Mckenzie and I made the decision to reorganize Entrust Financial as an independent fee-based firm in 2015, we chose the descriptor: Partners in Holistic Wealth Management.

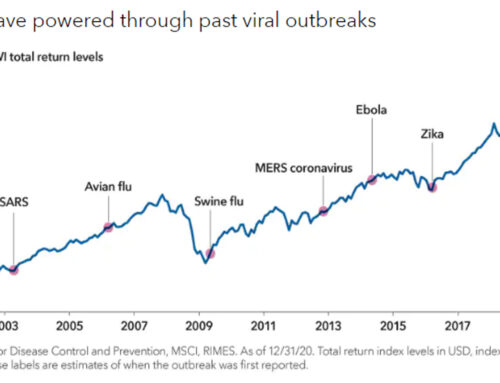

Our years of experience have continued to teach us that ensuring financial security and independence for clients is a holistic endeavor requiring more than astute investment planning. We have positioned ourselves as the financial quarterback, meaning we see the big picture, coordinate related professionals, deploy resources and respond with appropriate strategies within the context of life transitions and unexpected events. The job of our Entrust team is to be each client’s financial partner, the fundamental multi-faceted resource they can count on, no matter what.

Surprisingly, despite the benefit to clients of the extra layer of care offered when a holistic process is utilized, fewer than seven percent of financial advisors have adopted this service-delivery model. Rather, the financial services landscape has remained virtually unchanged over the past twenty years, with the vast majority of advisors trying hard to sell investment products, instead of addressing investors’ complex financial needs.

Whether you are preserving your affluence or are in the process of building your wealth, Gloria Steinem’s wry observation sums up the need for using a holistic approach: “Rich people plan for three generations; poor people plan for Saturday night.” Planning your personal finances for long-term success is not about a product sale. It is about achieving a holistic balance as you address your complex financial needs.

— Joslyn G. Ewart, CFP®