3 Things Investors Can Count On, Despite Market Volatility

Most of us want to retire—someday. And we aim for our investments to appreciate so that we can distribute income from them throughout our retirement years, without running low on money and equally importantly, without diminishing our style of living.

When the capital markets gradually appreciate, our goals for making work optional—retirement—feel good indeed. Now that volatility has returned with a vengeance, it can take a dose of faith to stay invested. However, there are three things we investors can count on, to support our faith in staying the course through unsettled as well as good times. At Entrust we refer to these three things as our investing bff’s (best friends forever). They are: risk, time, and compound returns.

Risk is our friend because it permits us to potentially earn enough with our money to outpace inflation. While this benefit may not feel so good on the downside, and during times of volatility, it feels great on the upside. (Remember 2017?) As we know, the nature of investing demands that if we want the upside benefits of risk, there are times when we have to live through the downside.

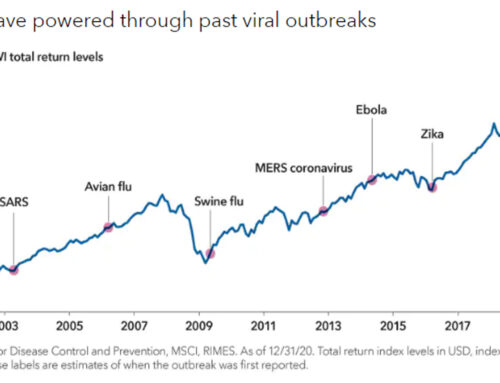

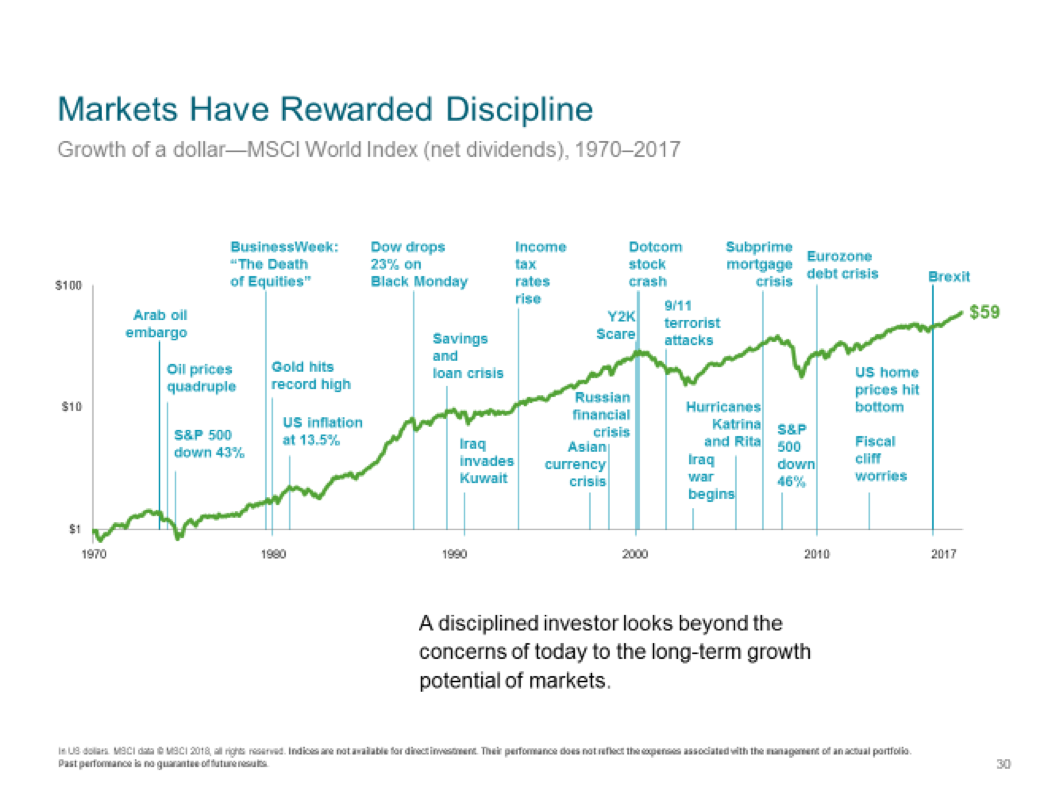

The long-term benefit of time is self-evident, especially when you review the chart below. During shorter-term periods of time, the invested dollar illustrated by the mountain chart may not have been growing; however, over the long-term, the growth was exponential. And consider, too, what a powerful illustration it is of the pay-off of staying invested regardless of world events, and the ups and downs of volatility.

This chart has special meaning to Joslyn because she invested her first dollar in 1976. By the end of 2017 that dollar became $59.00. She put up with every valley along the way, in the interest of the benefit of the appreciation gained at every peak. Just for fun, she did the following math:

Had Joslyn been able to invest $100,000 in 1976 (rather than just her first dollar as a new investor), that investment could have appreciated to $5,900,000 by the end of 2017.

What a powerful example of compound returns; each time the original dollar gained in value, subsequent gains applied not only to that dollar but to all previous earnings as well. It’s a beautiful thing!

Are you feeling worried about what 2019 will bring? For added confidence as you aim to stay the course in spite of volatility, click here. Better yet, contact us as info@entrustfinancial.com or 610.687.3515 to schedule a conversation about how to achieve your investment goals.